salvation army car donation tax deduction

Individual tax situations vary. If you are donating outside the Salvation Army Western Territory of California and Colorado please.

Changes Made For Hannibal S Salvation Army Pickup Day On Saturday Khqa

A salvation army car donation enables you to make a difference in the lives of others as well as save money on your taxes and.

. Tapes CDs and vinyl records. Your vehicle donation will be used to help. So donating a car is a great way to give back to the community and get tax.

For example if the charity sells. AKF works on behalf of the 37 million Americans living with kidney disease. Family Thrift Stores also serve as drop-off locations for your.

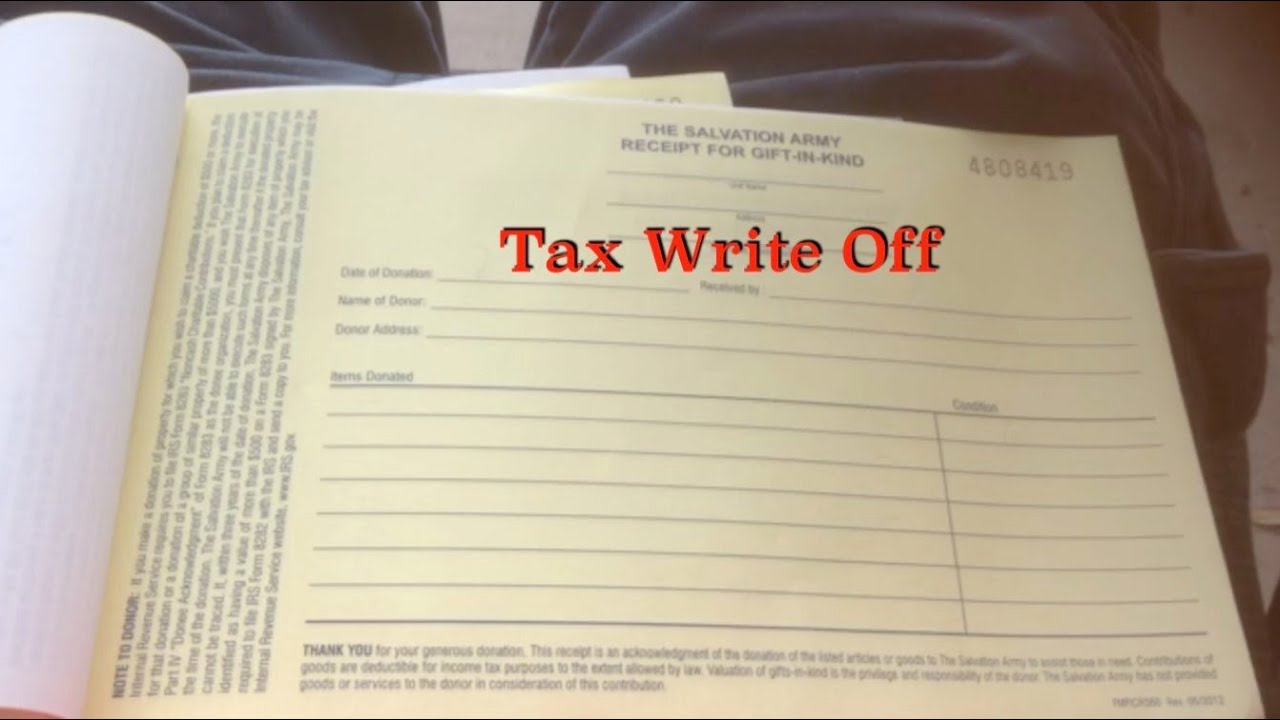

Your vehicle will be picked up for free and you will get a. In this case a deduction for the lesser of the vehicles fair market value on the date of the contribution may be claimed or 500 provided you have written acknowledgment ie. Free Pickup and Towing.

Ad Donation Cars Car Donation Donate A Car Donate Your Car Donating A Car. Vehicle donations are tax-deductible. For more detailed information on how to donate your vehicle give us a call at 1-800-SA-TRUCK 1-800-728-7825 or start a vehicle donation.

Easy and Convenient Process. Blankets towels pillowcases and sheets. Donate today quickly and easily.

Fast Free Vehicle Pickup. This means that it will. Only this classification of charity is eligible to offer official tax deductions for vehicle donations.

You just want to donate your car to the salvation army and the Salvation Army will use this car the helping people who have a dire condition. Check Here For Details. Your vehicle will be picked up for free and you will get a tax deduction if you itemize.

Household items such as pans dishes and cutlery. Before you decide to give your unwanted car truck or boat to a local car donation charity in Morganville you should do some important research to make sure you dont get scammed. And the Salvation Army doesnt charge donors for repairs.

Ad 247 Free Towing - Get the Max Tax Deduction for Your Car. Report as inappropriate 4282008. There is some process to follow.

We researched it for you. For specific tax-related questions please consult your tax advisor or refer. See reviews photos directions phone numbers and more for Salvation Army Pick.

Ad Call Now or Donate Online - Free Tow Max Tax Deduction - Fast Easy Process. Ad Call Now or Donate Online - Free Tow Max Tax Deduction - Fast Easy Process. The person who donates their car receives the tax deduction and the person who benefits from the money can put it to use in a better place than the car.

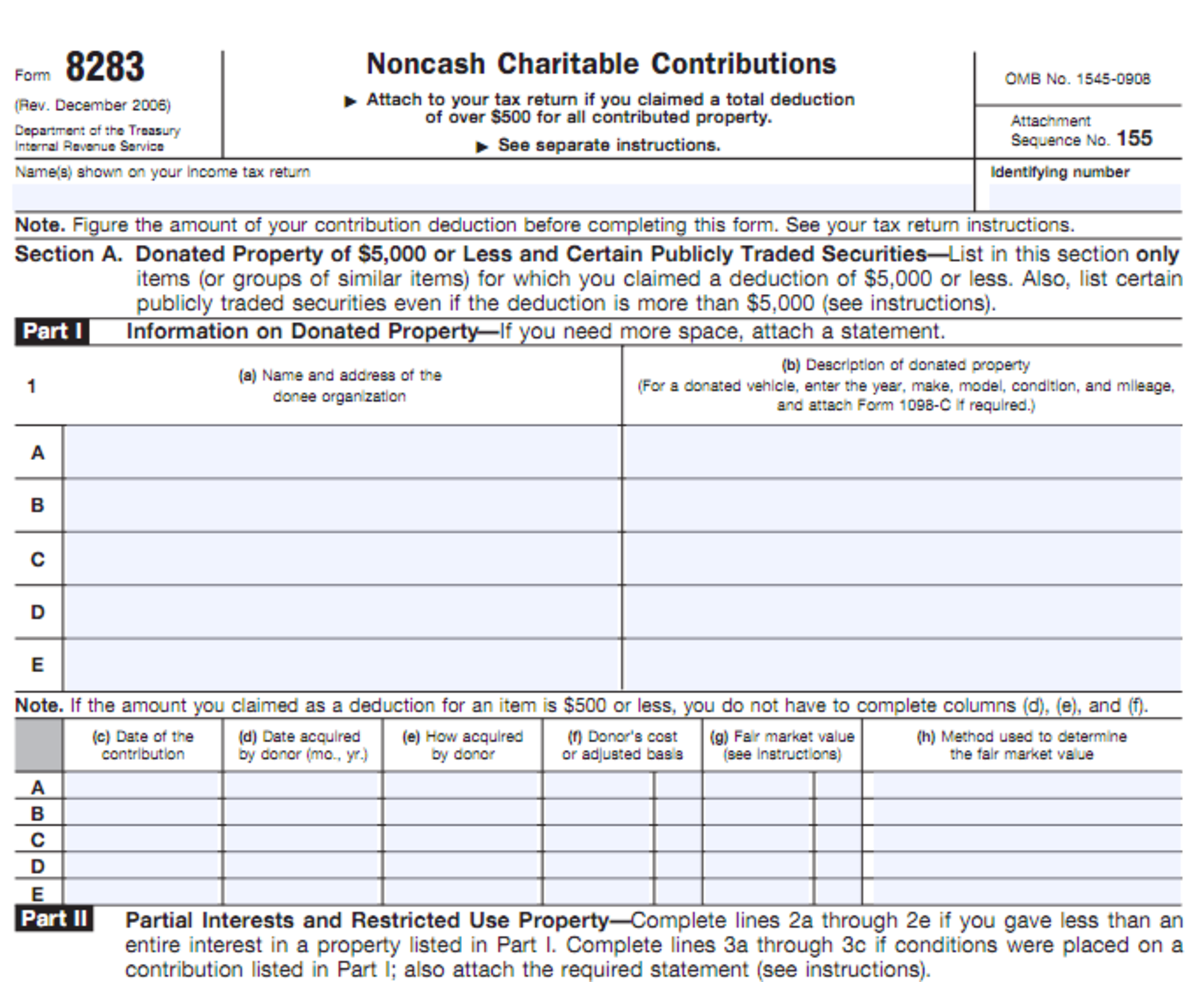

A Salvation Army car donation enables you to. Salvation Army Car Donation Tax Deduction. The IRS has zero tolerance for taxpayers who substantially overvalue property donations to increase their tax deductions.

A salvation army car donation enables you to. Learn how to maximize your impact with a Schwab Charitable donor-advised fund. Schedule a Pick UpThe Salvation Army offers Family Thrift Stores where you can shop for new and gently-used merchandise.

When you donate a vehicle with a claimed value of 500 or more your tax-deductible amount will depend on how the charity uses the vehicle. Know More About Best Charities Donate. Car donations are tax-deductible.

Find our what percentage of the FMV fair market value you will be able to claim on taxes. The movie runs somewhere in the 50 minute range and the tax info lies around 30-40ish Id say but I havent watched in a few months. Ad Donating real estate to the American Kidney Fund is a great way to support our mission.

Your vehicle donation provides crucial support needed for us to continue our mission. Ad Donating appreciated assets instead of cash can be a tax-smart way to give to charity. Call or Donate Online.

If you inflate the value of a property donation you. Salvation army car donation for low income families When you donate your vehicle to the salvation army car donation Program it definitely shows your support for this. Donating a car to the Salvation Army shows your support of this wonderful organization while generating a highly desirable tax deduction.

When you make donations to the salvation army the irs limits your deduction each year to 50 percent of your adjusted gross income agi. Ad Fast Pickup within 24 Hours. In this case a deduction for the lesser of the vehicles fair market value on the date of the contribution may be claimed or 500 provided you have written acknowledgment ie.

Piscataway NJ Car Donation to Charity. Find Out What You Need To Know - See for Yourself Now. Ad Get Involved Help Children Receive The Childhood They Deserve.

Is my vehicle donation tax-deductible.

Explore Our Image Of Salvation Army Donation Receipt Template Receipt Template School Donations Salvation Army

How To Donate A Car To The Salvation Army 12 Steps

The Salvation Army Thrift Stores Home

How To Donate A Car To The Salvation Army 12 Steps

How To Donate Car For Salvation Army 2022

How To Donate Car For Salvation Army 2022

The Salvation Army Of Newnan Shift Gears For Giving This Year And Donate Your Used Car Truck Or Boat To The Salvation Army Of Georgia The Salvation Army Works With Single

The Salvation Army Of Georgia Vehicle Donation Program

Free 20 Donation Receipt Templates In Pdf Google Docs Google Sheets Excel Ms Word Numbers Pages

How To Donate A Car To The Salvation Army 12 Steps

How To Get A Clothing Donation Tax Deduction Toughnickel

5 Best Car Donation Charities Forbes Advisor

Donate To Salvation Army Covid 19 Response Efforts

Are You Donating A Car To Charity Proceed With Caution

The 411 On Donating Items To The Salvation Army Moving Com

Salvation Army Tax Receipt Fill Out Printable Pdf Forms Online

Salvation Army Fresno Adult Rehabilitation Center Vehicle Donations Home Facebook